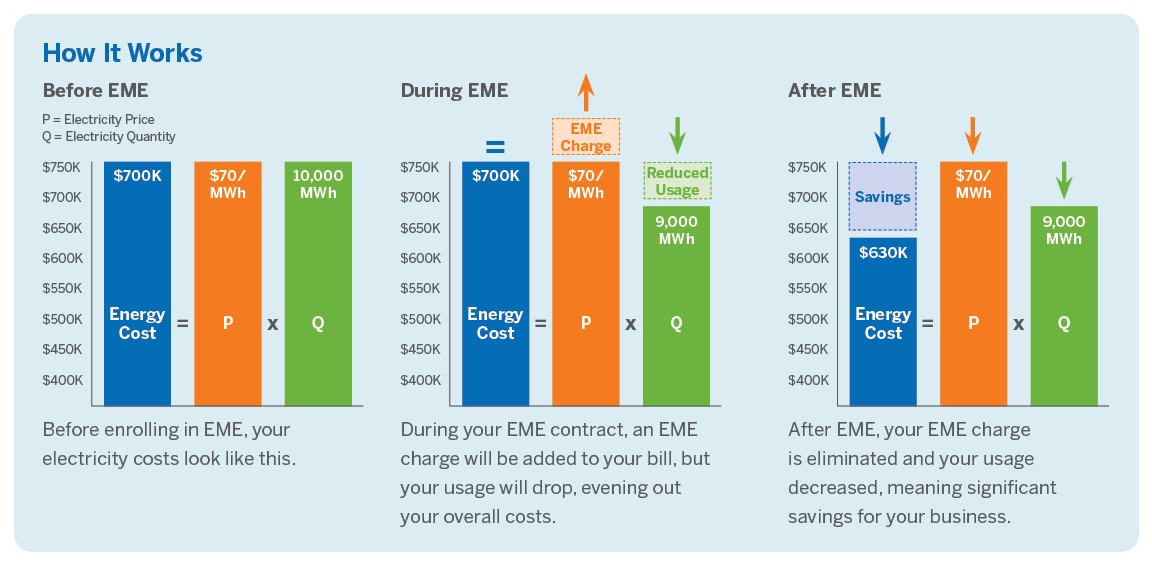

On-Bill Project Funding

This unique award-winning solution provides your organization with an opportunity to pay for energy conservation measures through monthly charges that appear on your power or natural gas supply bill from Constellation. You can realize cost savings through a reduction in energy consumption, maintenance costs and an improved load profile, which will positively impact future energy costs and your environmental goals.

Program Benefits:

Financing and Leasing

The financing of energy efficient equipment is indispensable in today’s rapidly changing climate. We offer financing programs and flexible payment options with long-term benefits that enable you to quickly put your Energy Management Plans into action with the least initial outlay.

We Offer:

P.A.C.E.

The Property Assessed Clean Energy (“PACE”) program is an alternative financing tool enabling owners of commercial and industrial properties to receive low-cost, long-term financing for energy efficiency, water efficiency and renewable energy projects. PACE is passed via state legislation and gives local governments the authority to collaborate with private lenders (such as Petros PACE Finance) to provide financing for Eligible Upgrades that are paid through a property tax assessment mechanism.

PACE financing enables businesses to generate immediate positive cash-flow by financing energy retrofits over a 15-30 year term; the property assessed characteristic of PACE makes this possible. By attaching the PACE loan repayment to the local government’s property tax special assessment process, PACE loans can be extended up to the useful life of the project, thereby making energy savings generated from the project greater than the loan repayment. In many states, this positive cash-flow is required before the project can be approved.

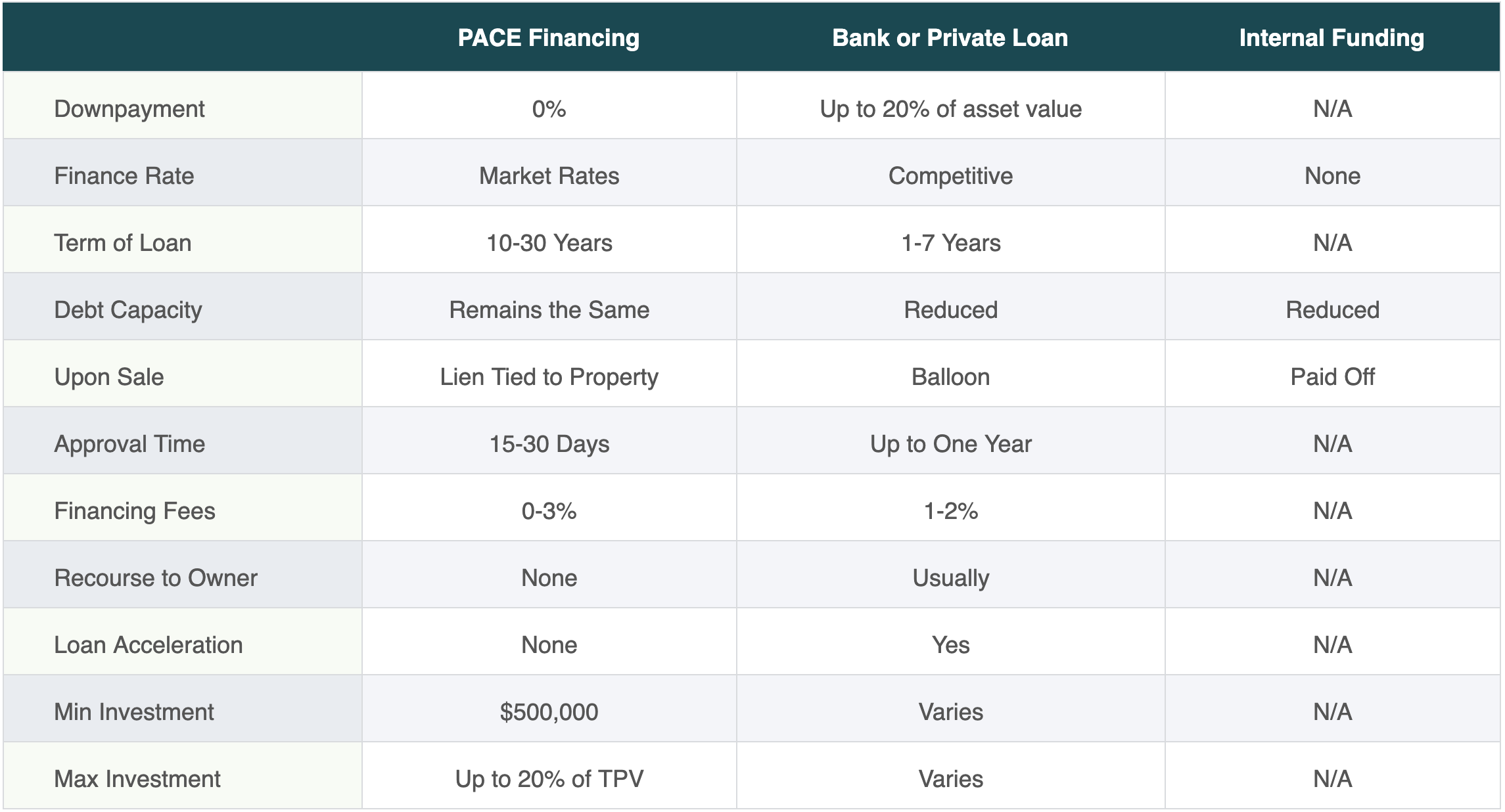

PACE vs. Alternatives

PACE financing is a game changer versus traditional financing options. PACE provides up to 20% LTV in addition to a mortgage (typically up to 80% LTV), effectively replacing equity investments with a loan from Petros PACE Finance.